522009 Shares of the Simon Property Group the biggest American shopping mall owner fell 8 percent after the company cut its dividend and 2009 earnings forecast. Simon Property Group SPG will cut its quarterly dividend by 381 percent to 130 per share.

The Reit Paradox Cheap Reits Stay Cheap Seeking Alpha Real Estate Investment Trust Reit Paradox

The Reit Paradox Cheap Reits Stay Cheap Seeking Alpha Real Estate Investment Trust Reit Paradox

Find the latest dividend history for Simon Property Group Inc.

Simon property cuts dividend. 572020 Simon Property Group Impact on portfolio dividendexpense coverage. Although other REITs have slashed dividends even more than Simon Property Group many investors are wondering if this is the beginning of the end for the big mall owners in America. The REIT was dividend growth stock having raised the dividend for 10 consecutive years.

This is a very carefully crafted message that probably took their investor relations team 10 days to come up with. Simon Property Group SPG is another real estate invest trust or REIT that has cut its dividend. 6302020 Tuesday June 30 2020 Simon Property Group SPG and Wells Fargo WFC to cut dividends Right after the market closed on Monday June 29 I learned that Simon Property Group SPG is cutting dividends per share.

Simon Property Group SPG Dividend Cut July 6 2020 January 8 2021 Dividend Power Simon Property Group SPG is another real estate invest trust or REIT that has cut its dividend. Read the official press release to know more. It gives the company some time to defer the difficult decision on cutting the dividend.

762020 Last Updated on January 8 2021 by Dividend Power. The companys board of directors has declared a new payout of 130 per share which is 38 lower than. 5122020 Simon intends to maintain a common stock dividend paid in cash and expects to distribute at least 100 of its REIT taxable income.

The commercial REIT last hiked its quarterly dividend by 24 percent to 210 per share in the third quarter of 2019. High 2 This is one I didnt expect a month or so ago but it goes to show that even A-rated ultra-safe considered giants. 112 sor 1042006 The historical dividend information is provided by Mergent a third party.

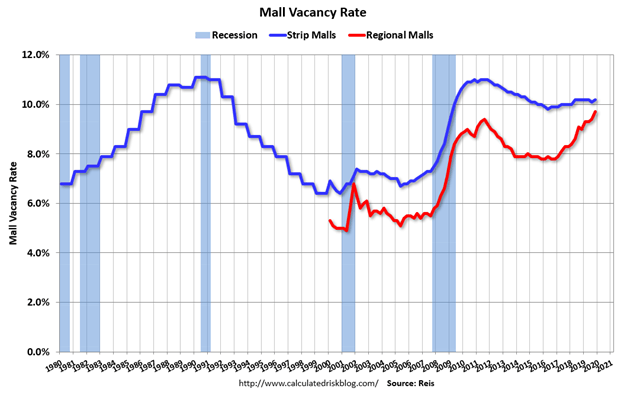

Mall REITs have taken a hit from COVID-19 with most having now cut their dividends. 692020 Simon Property Group Telegraphs a 50 Dividend Cut. NEW YORK May 1 Reuters - Simon Property Group Inc SPGN posted better-than-expected results on lower expenses but the largest US.

Simon intends to maintain a common stock dividend paid in cash and expects to distribute at least 100 of its REIT taxable income. Mall owner cut its cash and stock. Since then they have recovered well and the dividend payments have improved to over pre-recession levels.

It is a popular stock for those seeking income and dividend growth. This dividend cut will end the companys 10 year record of consecutive annual dividend increases. Analysts are expecting continued improvements in dividend payments despite a low dividend cover.

Simon is a real estate investment trust engaged in the ownership of premier shopping dining entertainment and mixed-use destinations. 782020 In order to preserve liquidity and tackle business uncertainity Simon Property Group SPG cuts dividend by 38. 722020 It recently announced a dividend cut of 38 to 130share which tells us a lot about how the company is doing financially at this time.

Simon Property Group cut their dividend during the global recession in 2009 which hit the US property market hard. Simon hasnt but. Dividend Reliability A stocks dividend reliability is determined by a healthy payout ratio that is higher than other stocks.

712020 Simon Property Group is conserving financial resources by reducing its quarterly dividend. 6302020 The dividend cut was announced within an operational update issued by the company. In that document Simon took pains to point out that it has around 85 billion in liquidity comprising roughly 35 billion in cash and 50 billion available in potential borrowings from a term loan and revolving credit facilities.

High dividend yields usually over 10 should be considered extremely risky while low dividend yields 1 or less are simply not very beneficial to long-term investors. 5152020 Simons Board of Directors will declare a common stock dividend for the second quarter before the end of June.

Bert S January Dividend Income Summary Seeking Alpha Dividend Income Dividend Income

Bert S January Dividend Income Summary Seeking Alpha Dividend Income Dividend Income

Retirement The Near Perfect Portfolio Revisited Seeking Alpha Portfolio Strategy Portfolio Retirement

Retirement The Near Perfect Portfolio Revisited Seeking Alpha Portfolio Strategy Portfolio Retirement

Forget Ibm Enbridge A Fast Growing 6 5 Yielding Blue Chip Is A Far Superior Investment Ebguf Seeking Alpha Investing Dividend Ibm

Forget Ibm Enbridge A Fast Growing 6 5 Yielding Blue Chip Is A Far Superior Investment Ebguf Seeking Alpha Investing Dividend Ibm

Various Reliable Billionaire Dividend Stocks For September October Seeking Alpha Dividend Stocks Stock Ticker Dividend

Various Reliable Billionaire Dividend Stocks For September October Seeking Alpha Dividend Stocks Stock Ticker Dividend

Lanny S March Dividend Income Summary Seeking Alpha Dividend Income Dividend Dividend Investing

Lanny S March Dividend Income Summary Seeking Alpha Dividend Income Dividend Dividend Investing

Biodelivery Sciences 4 Biopharma Stock Is Still A Good Bet Financial News Investing Science

Biodelivery Sciences 4 Biopharma Stock Is Still A Good Bet Financial News Investing Science

26 Cheap Stocks In The Market S Hottest Sector Marketwatch Cheap Stocks Marketing Tech Stocks

26 Cheap Stocks In The Market S Hottest Sector Marketwatch Cheap Stocks Marketing Tech Stocks

We Are Rounding Third On 2020 And Heading Home In November We Received 604 78 In Dividend Income Dividend Income Stock Market Investing Dividend Investing

We Are Rounding Third On 2020 And Heading Home In November We Received 604 78 In Dividend Income Dividend Income Stock Market Investing Dividend Investing

2020 List Of All Reits 166 Publicly Traded Reits Sure Dividend En 2020

2020 List Of All Reits 166 Publicly Traded Reits Sure Dividend En 2020

Commodities Vs Equities Rule Of Thumb S P 500 Index Marketing

Commodities Vs Equities Rule Of Thumb S P 500 Index Marketing

Best Investment Site For Free Dividend Yield And Price To Earning Lists Of High And Best Dividend Stocks Dividend Investment Tips Best Investments

Best Investment Site For Free Dividend Yield And Price To Earning Lists Of High And Best Dividend Stocks Dividend Investment Tips Best Investments

Is Coconut Oil Good For Dogs Family Friendly Dogs Dogs Dog Care

Is Coconut Oil Good For Dogs Family Friendly Dogs Dogs Dog Care

Centro Comercial Propietario Cbl Problemas De Marcha De Advertencia Despues De Que Omiten El Real Estate Investment Trust Real Estate Investing Reit

Centro Comercial Propietario Cbl Problemas De Marcha De Advertencia Despues De Que Omiten El Real Estate Investment Trust Real Estate Investing Reit

Simon Property Group May Cut The Dividend Why I M Still Adding To My Position Nyse Spg Seeking Alpha

Simon Property Group May Cut The Dividend Why I M Still Adding To My Position Nyse Spg Seeking Alpha