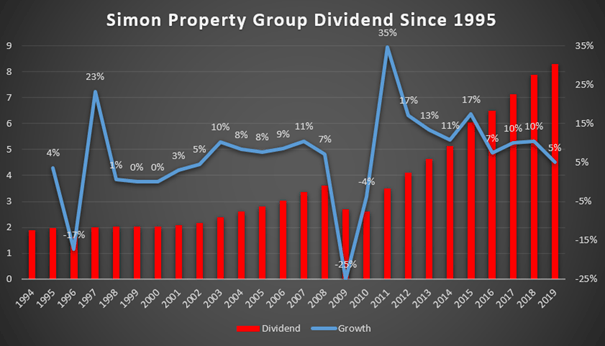

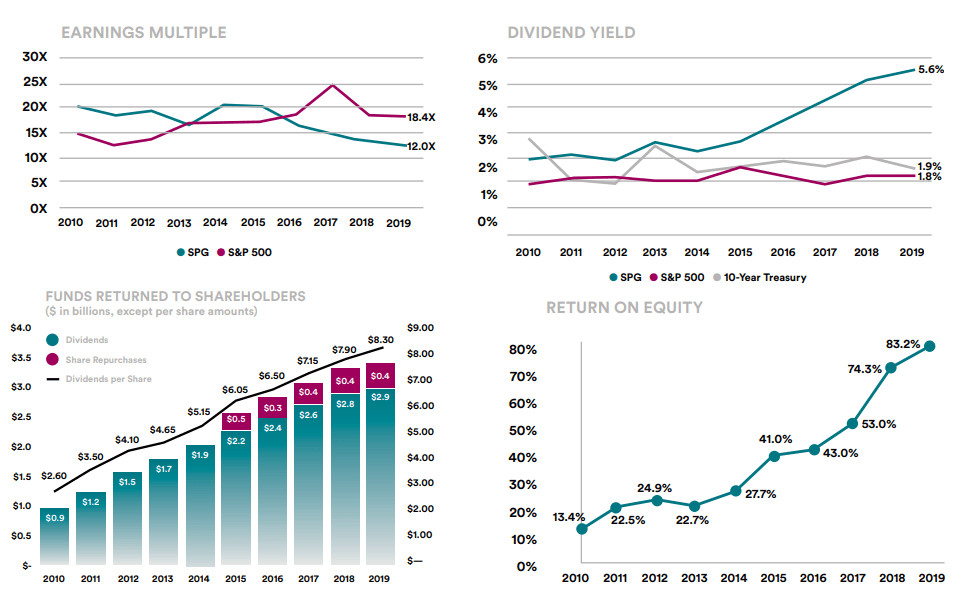

It is a popular stock for those seeking income and dividend growth. Since then they have recovered well and the dividend payments have improved to over pre-recession levels.

Simon Property Group 7 4 Yield Discounted Price Real Risks Nyse Spg Seeking Alpha

Simon Property Group 7 4 Yield Discounted Price Real Risks Nyse Spg Seeking Alpha

July 6 2020 January 8 2021 Dividend Power.

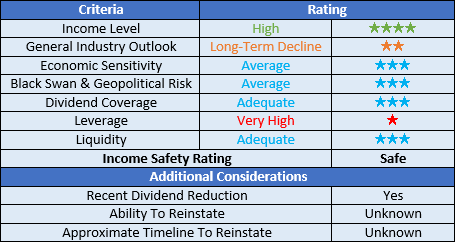

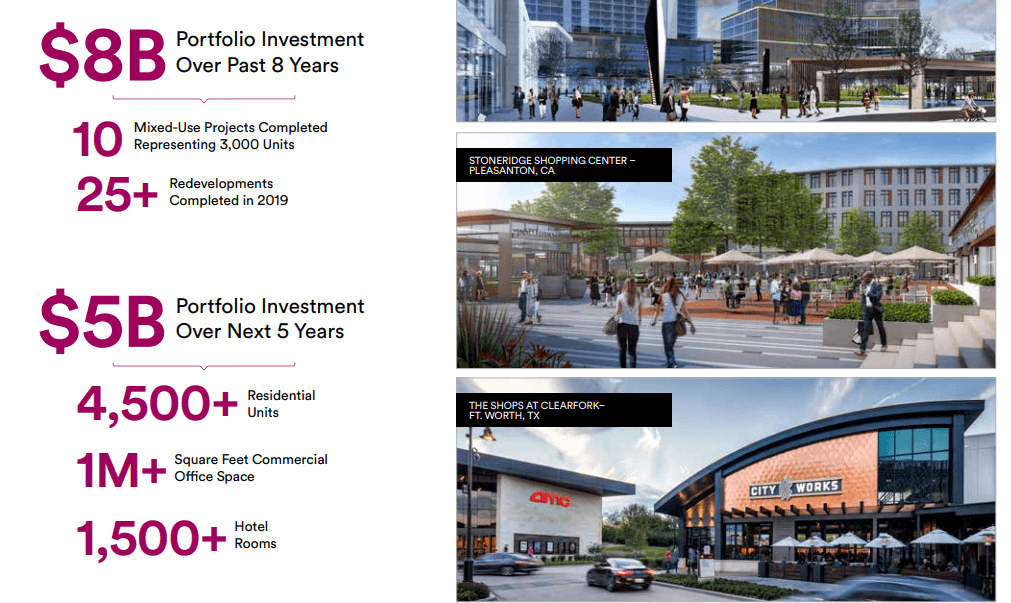

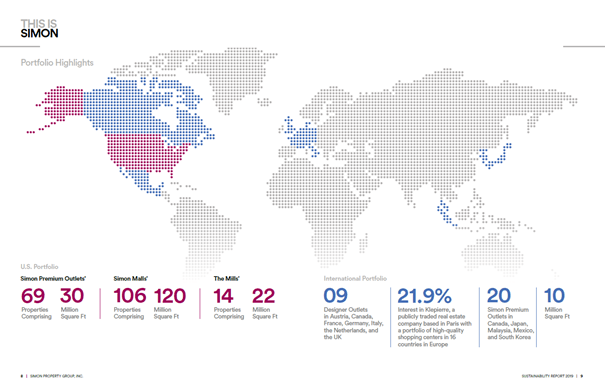

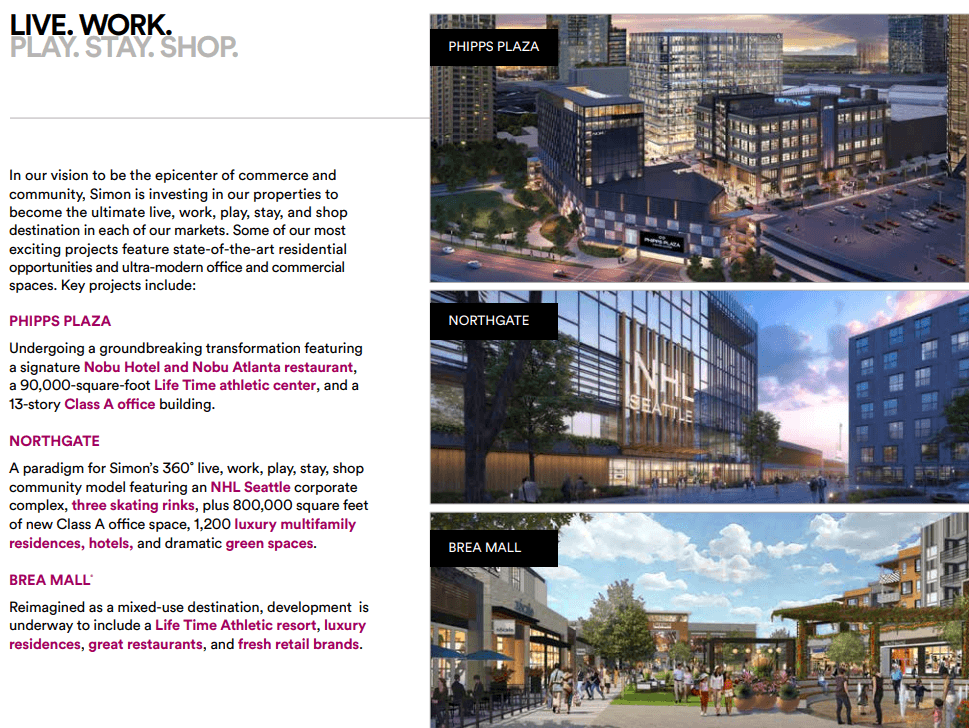

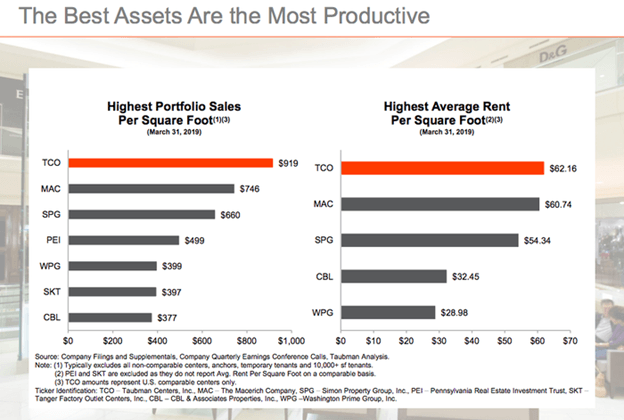

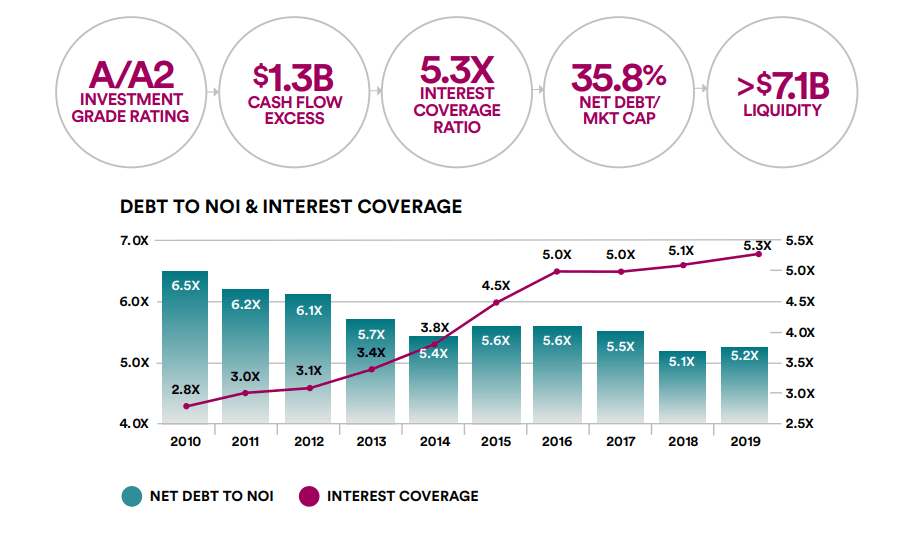

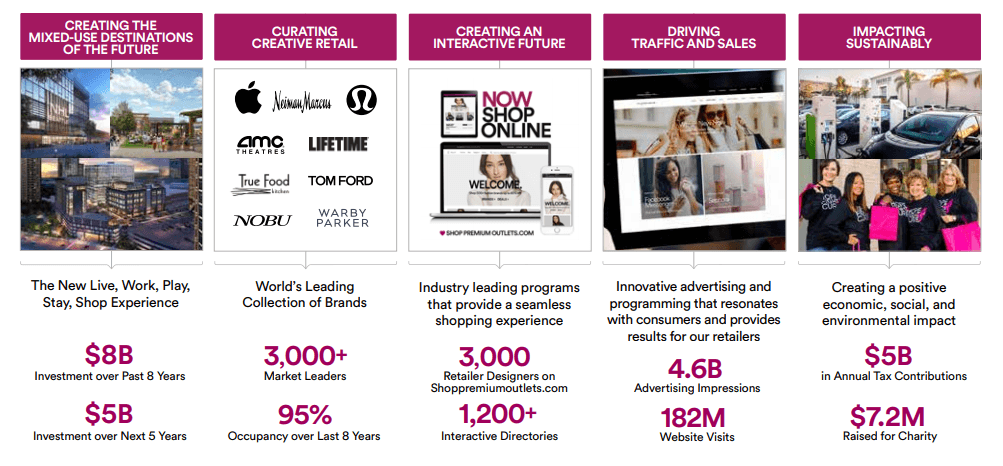

Simon property group cuts dividend. Over the past decade Simon has strengthened its balance sheet and is now one of the few A-rated REITs by credit rating agencies. Simon is a real estate investment trust engaged in the ownership of premier shopping dining entertainment and mixed-use destinations. This dividend cut will end the companys 10 year record of consecutive annual dividend increases.

5152020 Simons Board of Directors will declare a common stock dividend for the second quarter before the end of June. This continued until the first quarter of 2010 when the company. This made it a Dividend Contender before the cut.

The REIT was dividend growth stock having raised the dividend for 10 consecutive years. Simon intends to maintain a common stock dividend paid in cash and expects to distribute at least 100 of its REIT taxable income. 3242020 Simon cut the dividend in the second quarter of 2009 to 060 and provided a payment that consisted of 80 stock and 20 cash.

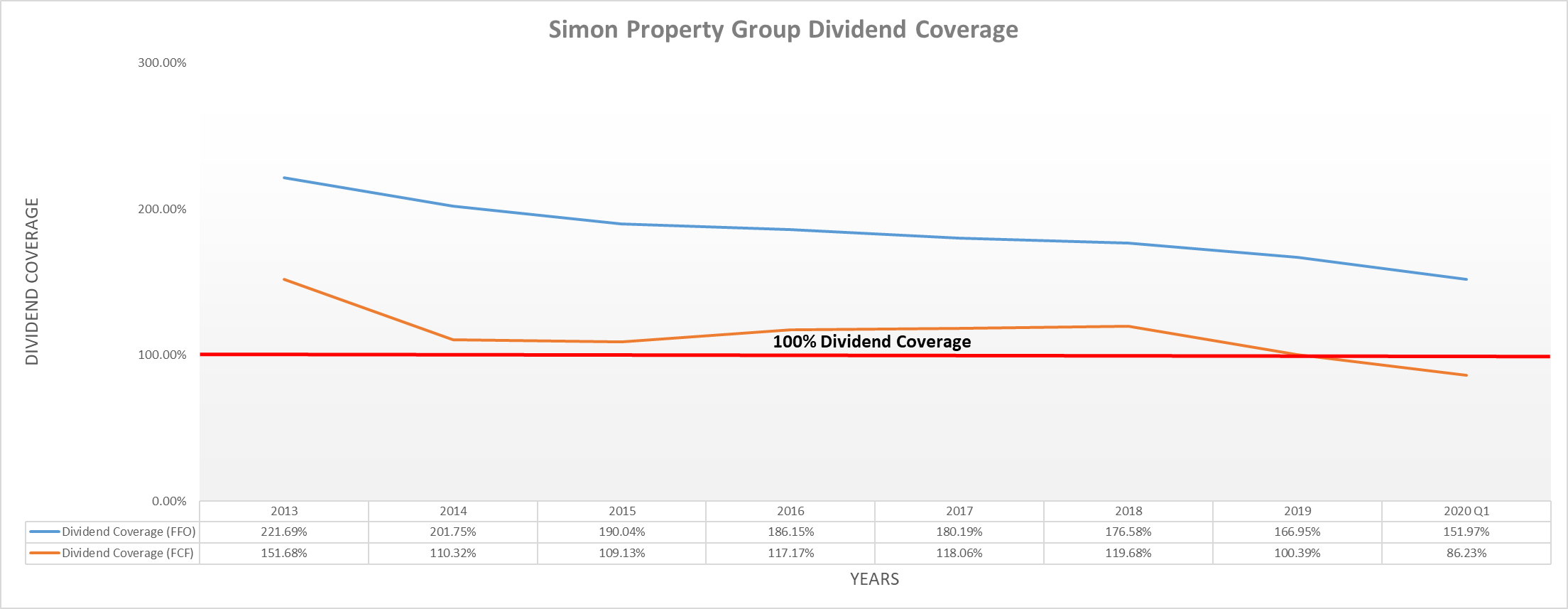

Simon intends to maintain a common stock dividend paid in cash and expects to distribute at least 100 of its REIT taxable income. Find the latest dividend history for Simon Property Group Inc. While the firm did cut its dividend during the Financial Crisis that was due to an overly leveraged balance sheet.

762020 Simon Property Group SPG is another real estate invest trust or REIT that has cut its dividend. NEW YORK May 1 Reuters - Simon Property Group Inc SPGN posted better-than-expected results on lower expenses but the largest US. Simon Property Group SPG will cut its quarterly dividend by 381 percent to 130 per share.

The commercial REIT last hiked its quarterly dividend by 24 percent to 210 per share in the third quarter of 2019. Analysts are expecting continued improvements in dividend payments despite a low dividend cover. Although most are re-opening a new wave of COVID-19 can force it to close them again.

The companys board of directors has declared a new payout of 130 per share which is 38. Simon Property Group cut their dividend during the global recession in 2009 which hit the US property market hard. 5132019 Simon has grown its dividend every year since 2010.

The forward dividend is 520 down from 600 representing a 133 decrease. The next lowered dividend of 130 per share will be payable on July 24. 712020 Simon Property Cut Its Dividend By 38 Simon Property Group NYSESPG cut its quarterly dividend from 210 to 130 per share.

5122020 Simons Board of Directors will declare a common stock dividend for the second quarter before the end of June. Simon Property Group SPG Dividend Cut. 712020 Simon Property Group NYSESPG is conserving financial resources by reducing its quarterly dividend.

Simon Property Group has recently cut its dividend. High dividend yields usually over 10 should be considered extremely risky while low dividend yields 1 or less are simply not very beneficial to long-term investors. Many of its retail properties were temporarily closed due to the COVID-19 pandemic.

722020 The good news about this dividend cut is that Simon Property Group was one of the last mall owners to reduce shareholder payouts and that it is only a temporary reduction. Mall owner cut its cash and stock dividend sending its. 6302020 Tuesday June 30 2020 Simon Property Group SPG and Wells Fargo WFC to cut dividends Right after the market closed on Monday June 29 I learned that Simon Property Group SPG is cutting dividends per share.

This companys balance sheet is strong which means that they should have enough cash to survive until social distancing subsides and foot traffic on their properties increases. 2122021 Given the upheaval and poor financial results its not particularly surprising that the real estate investment trust cut its dividend by just under 40 in 2020. The current payout ratio after the recent cut is 571.

Dividend Cuts and Suspensions Income Stocks REIT. 112 rows 1042006 Click Here for Information on Taxability of Dividends. A stocks dividend reliability is determined by a healthy payout ratio that is higher than other stocks.

It is a popular stock for those seeking. Simon Property Group SPG is another real estate invest trust or REIT that has cut its dividend.

Simon Property Group Don T Dismiss This Mall Reit Left Brain Investment Research

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

Simon Property Group As The Dividend Approaches 20 Don T Miss Out Nyse Spg Seeking Alpha

Simon Property Group As The Dividend Approaches 20 Don T Miss Out Nyse Spg Seeking Alpha

Simon Property Group Hunting For Bargains Again Nyse Spg Seeking Alpha

Simon Property Group Hunting For Bargains Again Nyse Spg Seeking Alpha

Simon Property Group Hunting For Bargains Again Nyse Spg Seeking Alpha

Simon Property Group Hunting For Bargains Again Nyse Spg Seeking Alpha

Simon Property Group As The Dividend Approaches 20 Don T Miss Out Nyse Spg Seeking Alpha

Simon Property Group As The Dividend Approaches 20 Don T Miss Out Nyse Spg Seeking Alpha

Simon Property Group May Cut The Dividend Why I M Still Adding To My Position Nyse Spg Seeking Alpha

Simon Property Group May Cut The Dividend Why I M Still Adding To My Position Nyse Spg Seeking Alpha

Simon Property Group As The Dividend Approaches 20 Don T Miss Out Nyse Spg Seeking Alpha

Simon Property Group As The Dividend Approaches 20 Don T Miss Out Nyse Spg Seeking Alpha

Simon Property Group A High Yield Reit Adapting To The Times Intelligent Income By Simply Safe Dividends

Simon Property Group Spg A High Yield And High Risk Reit Dividend Growth Investor

Simon Property Group Spg A High Yield And High Risk Reit Dividend Growth Investor

Simon Property Group As The Dividend Approaches 20 Don T Miss Out Nyse Spg Seeking Alpha

Simon Property Group As The Dividend Approaches 20 Don T Miss Out Nyse Spg Seeking Alpha

Simon Property Group As The Dividend Approaches 20 Don T Miss Out Nyse Spg Seeking Alpha

Simon Property Group As The Dividend Approaches 20 Don T Miss Out Nyse Spg Seeking Alpha

Mall Owners Simon Taubman Revise Merger Terms 800 Million Price Cut

Mall Owners Simon Taubman Revise Merger Terms 800 Million Price Cut

How To Invest In Reits Pros Cons And Simon Property Group Example Analysis Sven Carlin

How To Invest In Reits Pros Cons And Simon Property Group Example Analysis Sven Carlin