Common Stock SPG Nasdaq Listed. But CEO David Simon.

The Reit Paradox Cheap Reits Stay Cheap Seeking Alpha Real Estate Investment Trust Reit Paradox

The Reit Paradox Cheap Reits Stay Cheap Seeking Alpha Real Estate Investment Trust Reit Paradox

Provided by The Motley Fool Simon Property Group Telegraphs a 50 Dividend Cut Although many of its peers have cut dividends Simon has yet to discuss its dividend plans.

Simon property cut dividend. 112 sor 1042006 The historical dividend information is provided by Mergent a third party. This made it a Dividend Contender before the cut. 762020 Simon Property Group SPG is another real estate invest trust or REIT that has cut its dividend.

The REIT was dividend growth stock having raised the dividend for 10 consecutive years. The companys board of directors has declared a new payout of 130 per share which is 38. Today Simons Board of Directors declared a 130 per common share dividend payable in cash for the second quarter 2020.

Simon is a real estate investment trust engaged in the ownership of premier shopping dining entertainment and mixed-use destinations. Simon Property Group Inc. Simon hasnt but its going to.

Although most are re-opening a new wave of COVID-19 can force it to close them again. SPGs next quarterly dividend payment will be made to shareholders of record on Friday April 23. Simon Property Group pays an annual dividend of 520 per share with a dividend yield of 454.

Considering the state of brick-and-mortar retail particularly in. Data is currently not available. It is a popular stock for those seeking income and dividend growth.

The next lowered dividend of 130 per share will be payable on July 24. 722020 Dividend investors never like to hear that one of their stocks is reducing its dividend payout but Simon Property Group essentially had no choice. This continued until the first quarter of 2010 when the company.

712020 Simon Property Group NYSESPG is conserving financial resources by reducing its quarterly dividend. 6302020 Tuesday June 30 2020 Simon Property Group SPG and Wells Fargo WFC to cut dividends Right after the market closed on Monday June 29 I learned that Simon Property Group SPG is cutting dividends per share. 3242020 Simon cut the dividend in the second quarter of 2009 to 060 and provided a payment that consisted of 80 stock and 20 cash.

Dividend Reliability A stocks dividend reliability is determined by a healthy payout ratio that is higher than other stocks. Mall owner cut its cash and stock dividend sending its stock. The dividend will be payable on July 24 2020 to.

Simon Property Group SPG will cut its quarterly dividend by 381 percent to 130 per share. 1005 088 DATA AS OF Apr 09 2021 957 AM ET. High dividend yields usually over 10 should be considered extremely risky while low dividend yields 1 or less are simply not very beneficial to long-term investors.

The commercial REIT last hiked its quarterly dividend by 24 percent to 210 per share in the third quarter of 2019. The company has grown its dividend for the last 1 consecutive years and is increasing its dividend by an average of -568 each year. Many of its retail properties were temporarily closed due to the COVID-19 pandemic.

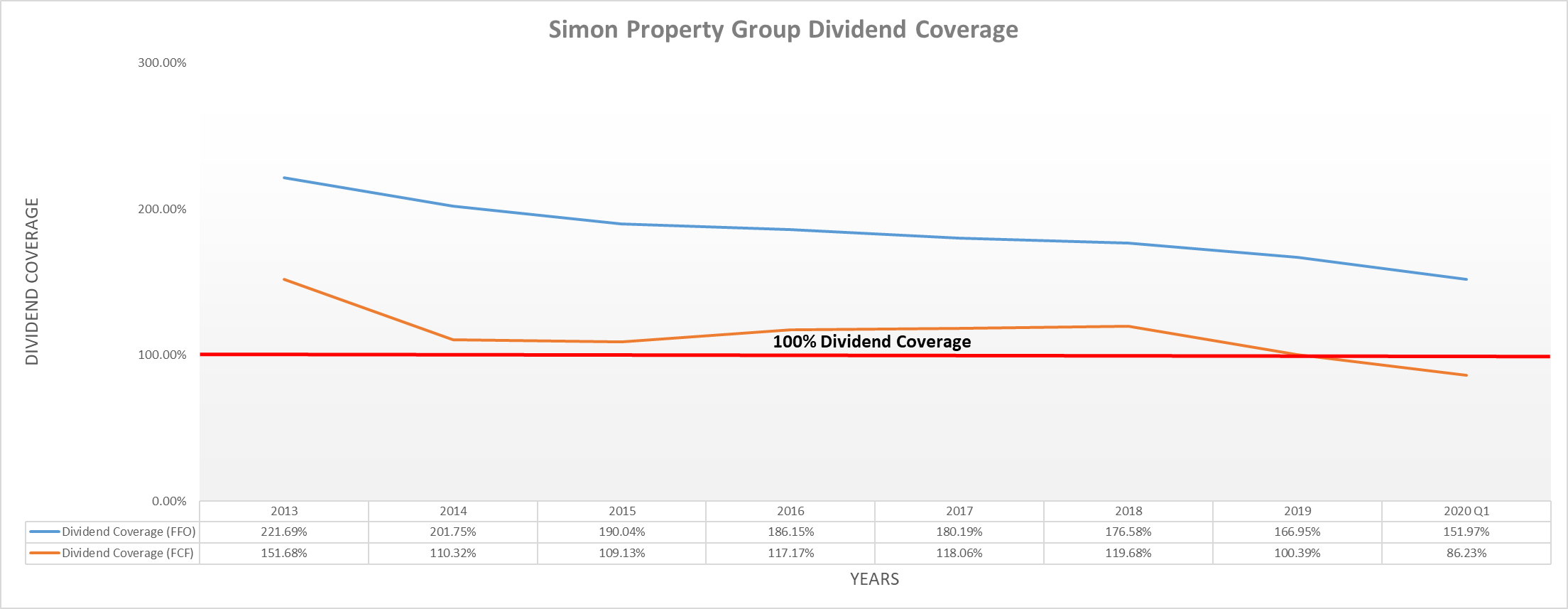

The brick and mortar retail industry were struggling mightily before the global pandemic hit and now companies that own malls are being forced to take drastic measures in order to preserve capital. Heres what the CEO had to. 10142020 With Simon Property Groups declining FFO and a recent dividend cut the quantitative model that runs SafetyNet Pro suggests another reduction in dividends in the next 12 months.

692020 Simon Property Group Telegraphs a 50 Dividend Cut Mall REITs have taken a hit from COVID-19 with most having now cut their dividends. 712020 Simon Property Cut Its Dividend By 38 Simon Property Group NYSESPG cut its quarterly dividend from 210 to 130 per share. This dividend cut will end the companys 10 year record of consecutive annual dividend increases.

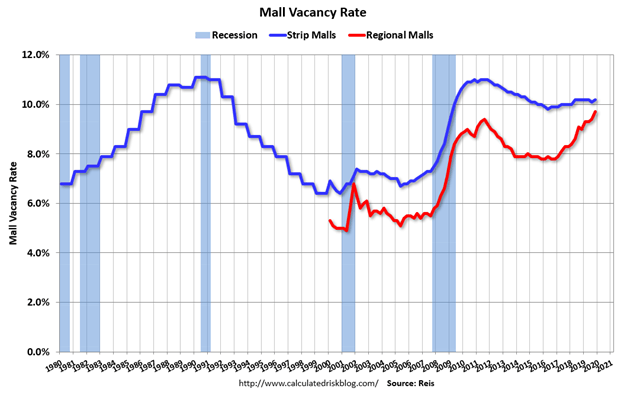

NEW YORK May 1 Reuters - Simon Property Group Inc SPGN posted better-than-expected results on lower expenses but the largest US. Thats very good news but the hit this real estate investment trust REIT is suffering through isnt over yet and thats on top of a big pre-existing headwind. 692020 The malls that Simon Property Group NYSE.

69 sor Simon Property Group cut their dividend during the global recession in 2009 which hit. SPG owns are starting to reopen again after being shut down by the government in an attempt to contain the spread of COVID-19.

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

Bert S January Dividend Income Summary Seeking Alpha Dividend Income Dividend Income

Bert S January Dividend Income Summary Seeking Alpha Dividend Income Dividend Income

Lanny S March Dividend Income Summary Seeking Alpha Dividend Income Dividend Dividend Investing

Lanny S March Dividend Income Summary Seeking Alpha Dividend Income Dividend Dividend Investing

We Are Rounding Third On 2020 And Heading Home In November We Received 604 78 In Dividend Income Dividend Income Stock Market Investing Dividend Investing

We Are Rounding Third On 2020 And Heading Home In November We Received 604 78 In Dividend Income Dividend Income Stock Market Investing Dividend Investing

Biodelivery Sciences 4 Biopharma Stock Is Still A Good Bet Financial News Investing Science

Biodelivery Sciences 4 Biopharma Stock Is Still A Good Bet Financial News Investing Science

Simon Property Group May Cut The Dividend Why I M Still Adding To My Position Nyse Spg Seeking Alpha

Simon Property Group May Cut The Dividend Why I M Still Adding To My Position Nyse Spg Seeking Alpha

Various Reliable Billionaire Dividend Stocks For September October Seeking Alpha Dividend Stocks Stock Ticker Dividend

Various Reliable Billionaire Dividend Stocks For September October Seeking Alpha Dividend Stocks Stock Ticker Dividend

26 Cheap Stocks In The Market S Hottest Sector Marketwatch Cheap Stocks Marketing Tech Stocks

26 Cheap Stocks In The Market S Hottest Sector Marketwatch Cheap Stocks Marketing Tech Stocks

2020 List Of All Reits 166 Publicly Traded Reits Sure Dividend En 2020

2020 List Of All Reits 166 Publicly Traded Reits Sure Dividend En 2020

Forget Ibm Enbridge A Fast Growing 6 5 Yielding Blue Chip Is A Far Superior Investment Ebguf Seeking Alpha Investing Dividend Ibm

Forget Ibm Enbridge A Fast Growing 6 5 Yielding Blue Chip Is A Far Superior Investment Ebguf Seeking Alpha Investing Dividend Ibm

Commodities Vs Equities Rule Of Thumb S P 500 Index Marketing

Commodities Vs Equities Rule Of Thumb S P 500 Index Marketing

Best Investment Site For Free Dividend Yield And Price To Earning Lists Of High And Best Dividend Stocks Dividend Investment Tips Best Investments

Best Investment Site For Free Dividend Yield And Price To Earning Lists Of High And Best Dividend Stocks Dividend Investment Tips Best Investments

Retirement The Near Perfect Portfolio Revisited Seeking Alpha Portfolio Strategy Portfolio Retirement

Retirement The Near Perfect Portfolio Revisited Seeking Alpha Portfolio Strategy Portfolio Retirement