The REIT was dividend growth stock having raised the dividend for 10 consecutive years. A stocks dividend reliability is determined by a healthy payout ratio that is higher than other stocks.

2020 List Of All Reits 166 Publicly Traded Reits Sure Dividend En 2020

2020 List Of All Reits 166 Publicly Traded Reits Sure Dividend En 2020

722020 The good news about this dividend cut is that Simon Property Group was one of the last mall owners to reduce shareholder payouts and that it is only a temporary reduction.

Will simon property cut dividend. SPGs next quarterly dividend payment will be made to shareholders of record on Friday April 23. 3242020 In the beginning of 2009 Simons dividend stood at 090 per share. Fears of dividend stability were moderately quenched late last month when Simon Property declared its dividend with a 38 cut from its February payout.

6302020 Tuesday June 30 2020 Simon Property Group SPG and Wells Fargo WFC to cut dividends Right after the market closed on Monday June 29 I learned that Simon Property Group SPG is cutting dividends per share. This companys balance sheet is strong which means that they should have enough cash to survive until social distancing subsides and foot traffic on their properties increases. With tight cash flowing through its.

This could indicate that the company has never provided a dividend or that a dividend is pending. Dividend history information is presently unavailable for this company. 762020 Last Updated on January 8 2021 by Dividend Power.

Simon Property Group SPG is another real estate invest trust or REIT that has cut its dividend. This is a very carefully crafted message that probably took their investor relations team 10 days to come up with. Many of its retail properties were temporarily closed due to the COVID-19 pandemic.

5212020 Therefore Simon might either cut its payouts to shareholders or walk away from a deal to buy Taubman Centers if the terms are not improved according to real estate activist investor Jonathan Litt. However in the first quarter of 2009 the company paid the dividend payout with 90 stock and 10 cash. Simon is a real estate investment trust engaged in the ownership of premier shopping dining entertainment and mixed-use destinations.

This dividend cut will end the companys 10 year record of consecutive annual dividend increases. The company has grown its dividend for the last 1 consecutive years and is increasing its dividend by an average of -568 each year. Many of its retail properties were temporarily closed due to the COVID-19 pandemic.

The next lowered dividend of 130 per share will be payable on July 24. Today Simons Board of Directors declared a 130 per common share dividend payable in cash for the second quarter 2020. The commercial REIT last hiked its quarterly dividend by 24 percent to 210 per share in the third quarter of 2019.

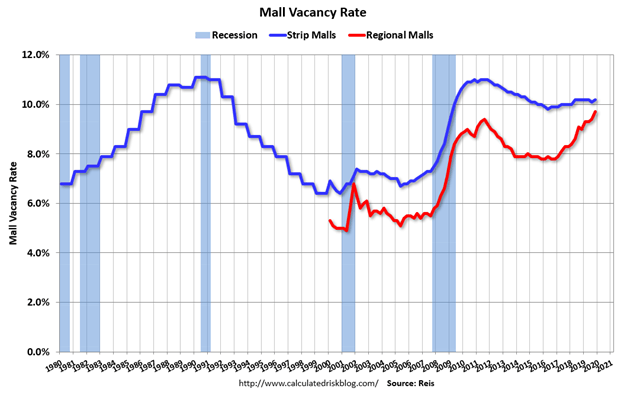

Mall REITs have taken a hit from COVID-19 with most having now cut their dividends. It is a popular stock for those seeking income and dividend growth. 692020 Simon Property Group Telegraphs a 50 Dividend Cut.

High dividend yields usually over 10 should be considered extremely risky while low dividend yields 1 or less are simply not very beneficial to long-term investors. Simon Property Group pays an annual dividend of 520 per share with a dividend yield of 454. Now keep in mind the company already cut its quarterly dividend in 2020 from 210 per share to 130.

5132020 Simon Likely to Cut Dividend This Summer May 13 2020. The dividend will be payable on. 10142020 So shareholders will be watching Simons earnings report closely to see whether its generous 77 dividend yield is sustainable.

Simon hasnt but. 712020 Simon Property Group NYSESPG is conserving financial resources by reducing its quarterly dividend. The companys board of directors has declared a new payout of 130 per share which is 38.

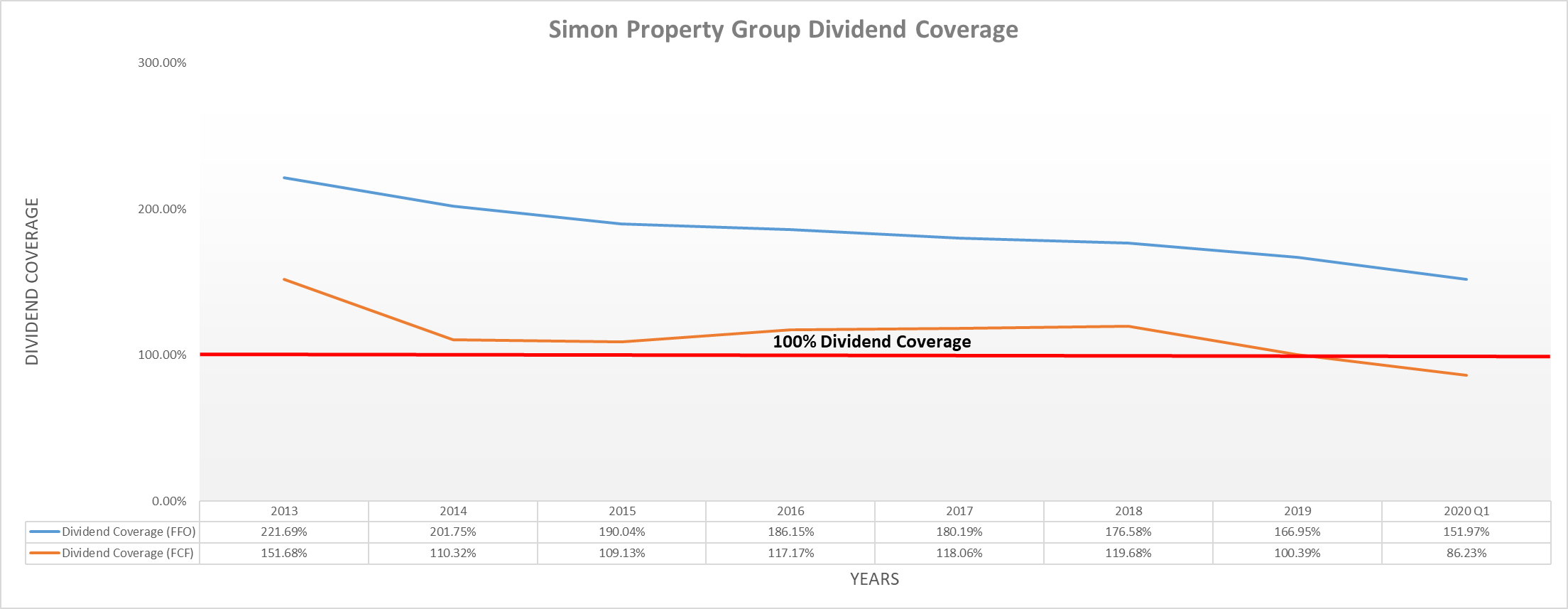

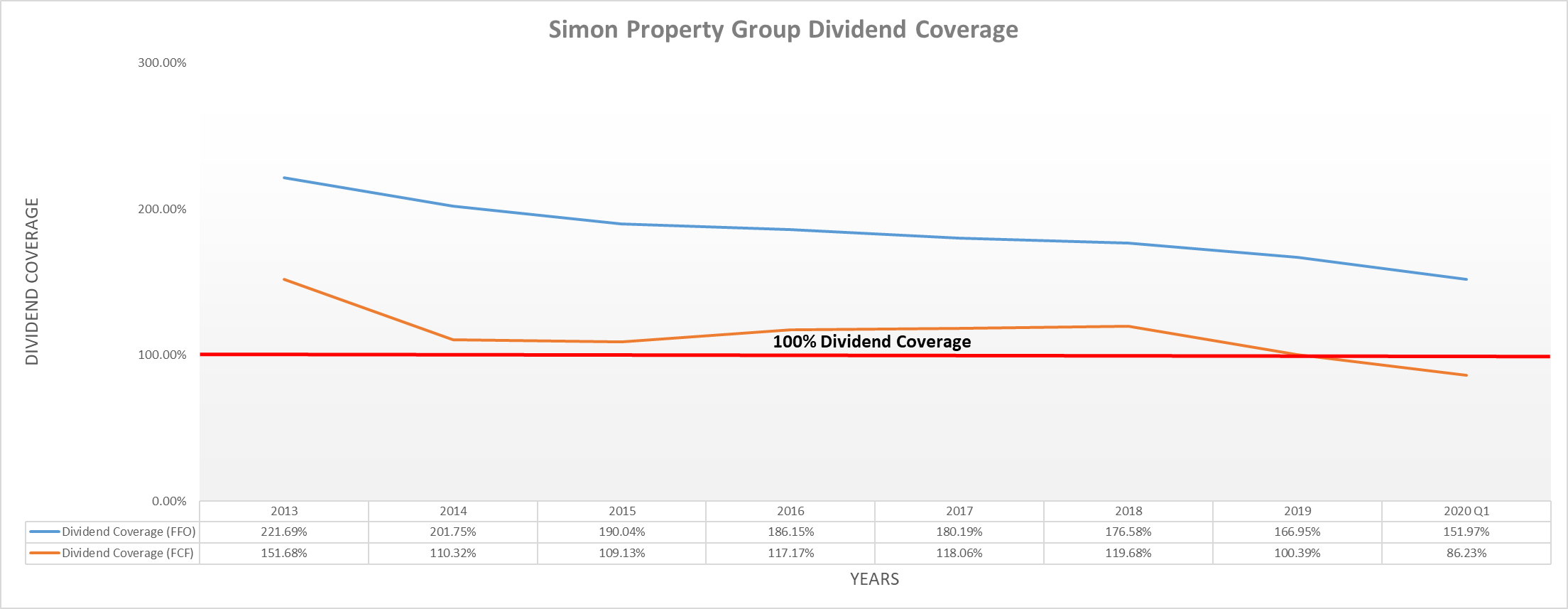

Simon Property said its funds from operations declined to 980 million in the first quarter from 108 during the same period last year. The reduction tarnished a solid annual dividend-raising track record going back to 2010. Simon Property Group SPG reported earnings on May 11.

712020 Simon Property Group NYSESPG cut its quarterly dividend from 210 to 130 per share. Simon cut the dividend. 5122020 Simon intends to maintain a common stock dividend paid in cash and expects to distribute at least 100 of its REIT taxable income.

69 sor Simon Property Group cut their dividend during the global recession in 2009 which hit. Simon Property Group SPG will cut its quarterly dividend by 381 percent to 130 per share. Management disclosed few specifics dodging questions about how much rent was collected in April and the status of its pending acquisition of Taubman.

It gives the company some time to defer the difficult decision on cutting the dividend.

Biodelivery Sciences 4 Biopharma Stock Is Still A Good Bet Financial News Investing Science

Biodelivery Sciences 4 Biopharma Stock Is Still A Good Bet Financial News Investing Science

Simon Property Group And Its 8 Dividend Yield Is My Highest Ever Conviction Buy Nyse Spg Seeking Alpha

Simon Property Group And Its 8 Dividend Yield Is My Highest Ever Conviction Buy Nyse Spg Seeking Alpha

The Costs Involved In Buying A House For Sale Property Investor Real Estate Estate Agent

The Costs Involved In Buying A House For Sale Property Investor Real Estate Estate Agent

The Reit Paradox Cheap Reits Stay Cheap Seeking Alpha Real Estate Investment Trust Reit Paradox

The Reit Paradox Cheap Reits Stay Cheap Seeking Alpha Real Estate Investment Trust Reit Paradox

Simon Property Group May Cut The Dividend Why I M Still Adding To My Position Nyse Spg Seeking Alpha

Simon Property Group May Cut The Dividend Why I M Still Adding To My Position Nyse Spg Seeking Alpha

Commodities Vs Equities Rule Of Thumb S P 500 Index Marketing

Commodities Vs Equities Rule Of Thumb S P 500 Index Marketing

Lanny S March Dividend Income Summary Seeking Alpha Dividend Income Dividend Dividend Investing

Lanny S March Dividend Income Summary Seeking Alpha Dividend Income Dividend Dividend Investing

We Are Rounding Third On 2020 And Heading Home In November We Received 604 78 In Dividend Income Dividend Income Stock Market Investing Dividend Investing

We Are Rounding Third On 2020 And Heading Home In November We Received 604 78 In Dividend Income Dividend Income Stock Market Investing Dividend Investing

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

Forget Ibm Enbridge A Fast Growing 6 5 Yielding Blue Chip Is A Far Superior Investment Ebguf Seeking Alpha Investing Dividend Ibm

Forget Ibm Enbridge A Fast Growing 6 5 Yielding Blue Chip Is A Far Superior Investment Ebguf Seeking Alpha Investing Dividend Ibm

Bert S January Dividend Income Summary Seeking Alpha Dividend Income Dividend Income

Bert S January Dividend Income Summary Seeking Alpha Dividend Income Dividend Income

Best Investment Site For Free Dividend Yield And Price To Earning Lists Of High And Best Dividend Stocks Dividend Investment Tips Best Investments

Best Investment Site For Free Dividend Yield And Price To Earning Lists Of High And Best Dividend Stocks Dividend Investment Tips Best Investments

Various Reliable Billionaire Dividend Stocks For September October Seeking Alpha Dividend Stocks Stock Ticker Dividend

Various Reliable Billionaire Dividend Stocks For September October Seeking Alpha Dividend Stocks Stock Ticker Dividend