Mall owner Simon Property Group have been battered along with the rest of its industry this year as retailers shutter thousands of stores in malls permanently and. 5112020 In other words this scenario implies that over a decade and a half after the COVID-19 pandemic Simon Property Groups profits will have only.

Simon Property Group Fears Vs Facts Nyse Spg Seeking Alpha

Simon Property Group Fears Vs Facts Nyse Spg Seeking Alpha

Simon Property Group Inc.

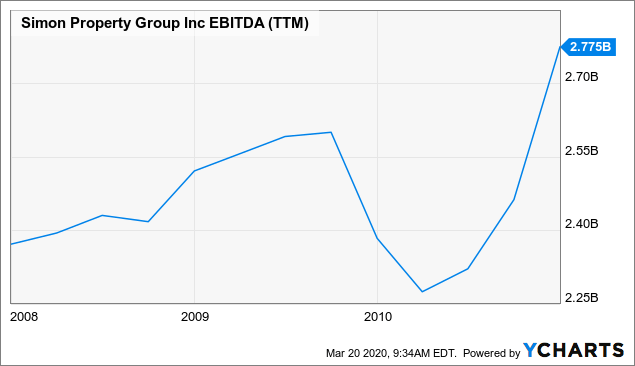

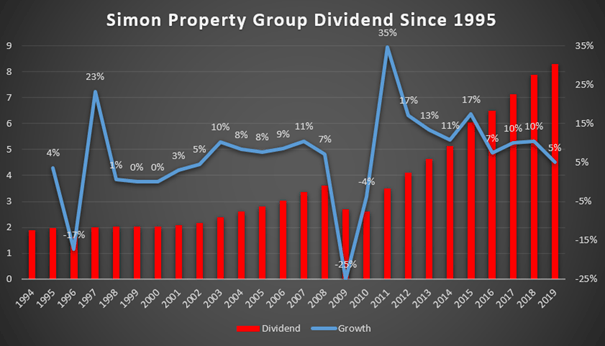

Will simon property group survive. 10132020 Simon Propertys revenues grew 7 from 54 Bil in 2016 to 58 Bil in 2019. 6202020 Retail REIT Simon Property Group SPG recently announced that it would not be cutting its dividend by more than 50. It ended the second quarter.

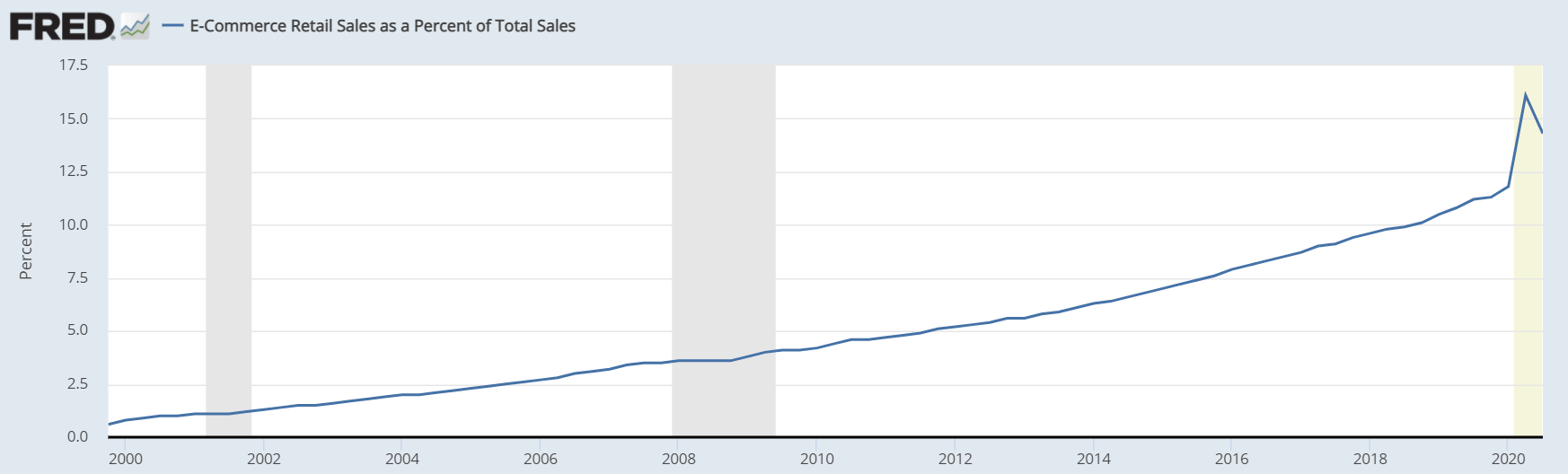

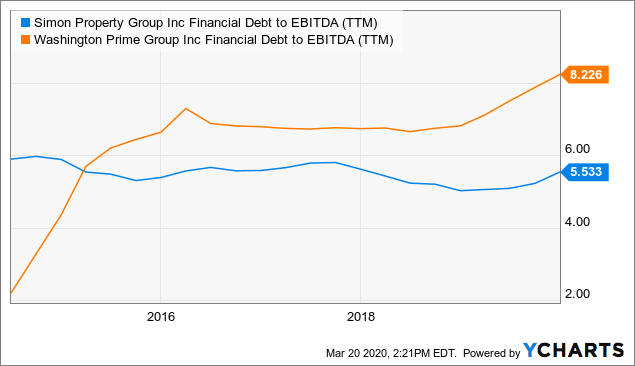

2212020 Simon remains in arguably the best position to survive long term as a premium mall owner but doing so will take constant investment and reinvention. If Simon can survive this rough patch it does have the potential to thrive yet again. It generates most of its revenues from rents arising from its operations as a self-administered real estate investment trust.

Announced today that it would snap up 80 of Taubman Realty Group Limited Partnership which is owned by Taubman Centers Inc. 7292019 Marriott International says it will open five hotels at Simon malls over the next few years adding to the roughly 15 Marriott already has at Simons properties. If you follow Simon Property Group or have considered investing in it youve probably noticed all of the recent negative headlines.

10152020 Shares of the biggest US. 4142020 Simon Property Group Inc NYSE. SPG and its mall peers are likely to face unprecedented challenges and uncertainties even when the world reopens after the lockdowns according to BofA Securities.

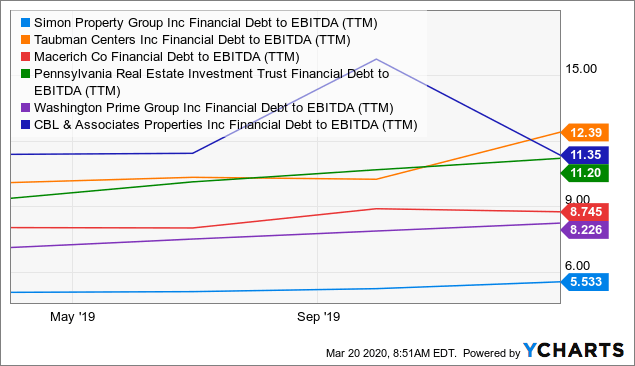

10212020 Simon has been able to go on the offensive because it has one of the best balance sheets in the REIT sector. Is a self-administered self-managed real estate investment trust REIT. And considering the companys robust balance sheet they wont need to.

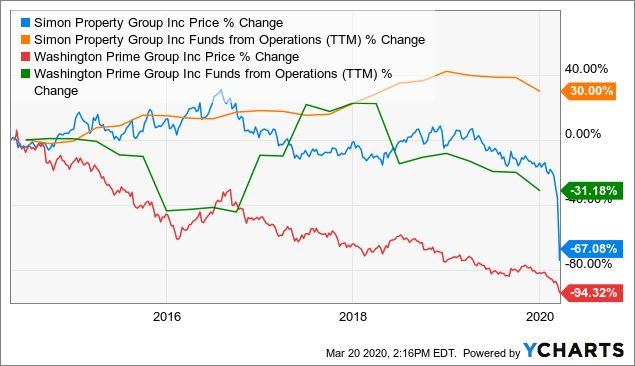

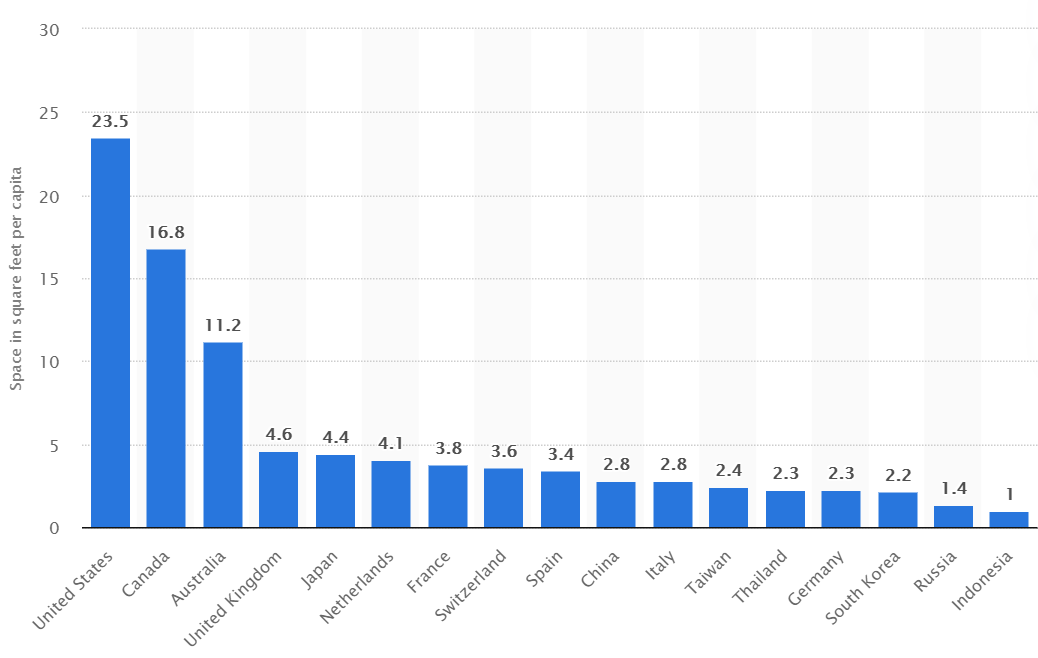

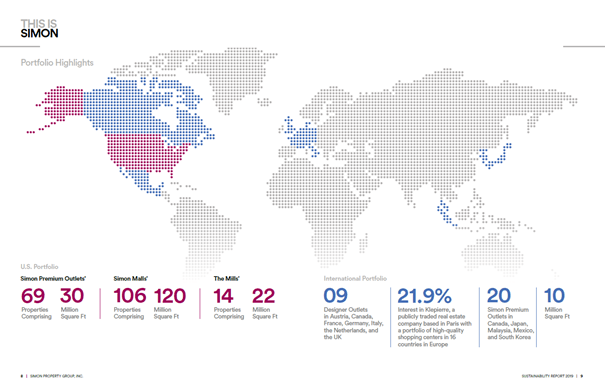

With ownership or interest in more than 240 properties and a total market capitalization of 17 billion the Indianapolis Indiana-based company is the largest REIT in the world. SPG is Americas premier shopping mall operator. Clearly the coronavirus has made a bad situation worse as the shift to online shopping and away from brick-and-mortar retailers has accelerated.

There is a great synergy when you combine Marriotts innovative hotels and Simons exciting shopping dining entertainment and mixed-use properties said Patrick Peterman Simons vice president of. 3172021 Will Simon Property Group Survive. 8252020 Simon Property Group has become adept to evolving its business model Talbot said.

Simon will survive and will be a source of attractive income potential for investors during and after the pandemic. I am still very bullish over the long term and have a high degree of confidence that SPG will survive. 2102020 Simon Property Group Inc.

3312020 Simon Property Group is reportedly furloughing nearly a third of its workforce as the impact of the coronavirus spreads from retailers to mall owners. Simon Property Group NYSESPG has so far been able to withstand the pandemic onslaught though its business has sufferred for obvious reasons. The company owns 168 properties providing business space to a variety of enterprises including dining shopping and entertainment outlets.

As part of the deal Simon will acquire. In addition earnings growth on a per-share basis was higher. 6202020 Despite the gloom and doom we believe stronger mall REIT players eg.

My core investment in the mall space has traditionally been through Simon Property Group. 782020 Simon Property Group will be a retail apocalypse survivor Theres no doubt that the retail apocalypse is having an impact on Simon Property. 2212020 Recent news out of Indianapolis Indiana home of Simon Properties Group suggest an increased clarity in the prognosis for mall and centers sustainability and it supports the notion that only the strong survive Simons 80 purchase of Taubmans mall portfolio and their decision to joint venture with Brookfield Property Partners LP and Authentic Brands Group LLC to purchase.

The companys longevity expertise and internal data provide insight into which brands might be good to salvage. 722020 Although its concerning to see a dividend cut things are a lot worse for other major mall REITs.

Simon Property Group Spg Reports Q1 2020 Earnings

Simon Property Group Spg Reports Q1 2020 Earnings

Simon Property Group Indianapolis Business Journal

Simon Property Group Indianapolis Business Journal

Simon Property Group Sell Off Goes Too Far Nyse Spg Seeking Alpha

Simon Property Group Sell Off Goes Too Far Nyse Spg Seeking Alpha

Amazon Simon Kick Off Mall Transformation Pymnts Com

Amazon Simon Kick Off Mall Transformation Pymnts Com

Simon Property Group Spg Reports Q1 2020 Earnings

Simon Property Group Spg Reports Q1 2020 Earnings

Simon Property Group Asserting Dominance Over Competitors Nyse Spg Seeking Alpha

Simon Property Group Asserting Dominance Over Competitors Nyse Spg Seeking Alpha

Simon Property Stock Down 50 Ytd Can It Survive The Covid Storm

Simon Property Stock Down 50 Ytd Can It Survive The Covid Storm

Simon Property Group Sell Off Goes Too Far Nyse Spg Seeking Alpha

Simon Property Group Sell Off Goes Too Far Nyse Spg Seeking Alpha

Simon Property Group Sell Off Goes Too Far Nyse Spg Seeking Alpha

Simon Property Group Sell Off Goes Too Far Nyse Spg Seeking Alpha

1 Question Simon Property Group Needs To Answer The Motley Fool

1 Question Simon Property Group Needs To Answer The Motley Fool

What Does The Future Hold For Malls Look To Simon Property Group

What Does The Future Hold For Malls Look To Simon Property Group

Simon Property Group Asserting Dominance Over Competitors Nyse Spg Seeking Alpha

Simon Property Group Asserting Dominance Over Competitors Nyse Spg Seeking Alpha

Simon Property Group And Taubman Centers Merger Is Back On

Simon Property Group And Taubman Centers Merger Is Back On

Simon Property Group Hunting For Bargains Again Nyse Spg Seeking Alpha

Simon Property Group Hunting For Bargains Again Nyse Spg Seeking Alpha

Simon Property Group Sell Off Goes Too Far Nyse Spg Seeking Alpha

Simon Property Group Sell Off Goes Too Far Nyse Spg Seeking Alpha

Simon Property Stock Down 50 Ytd Can It Survive The Covid Storm

Simon Property Stock Down 50 Ytd Can It Survive The Covid Storm

Simon Property Group Indianapolis Business Journal

Simon Property Group Indianapolis Business Journal

Simon Property Group Hunting For Bargains Again Nyse Spg Seeking Alpha

Simon Property Group Hunting For Bargains Again Nyse Spg Seeking Alpha

The Retail Apocalypse Is Far From Over And Simon Property Group Is Not Immune Nyse Spg Seeking Alpha

The Retail Apocalypse Is Far From Over And Simon Property Group Is Not Immune Nyse Spg Seeking Alpha